An online personal loan is an easily available financial solution that provides access to emergency cash. It also provides faster approval and quick disbursal of loans, and you need no collateral. So, it is the most convenient loan that you can get online if you face financial emergencies.

It can be accessed anytime since it is available online with fibe. Digital lending can be availed through mobile applications or websites; these online loans can be delivered through banks as well as NBFCs.

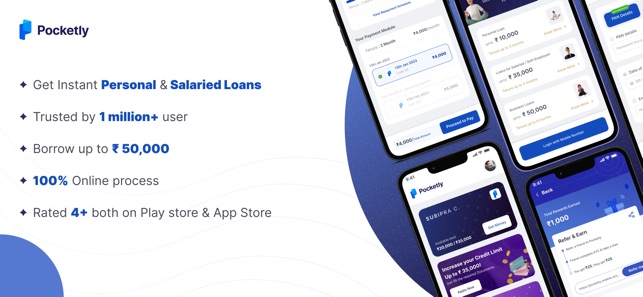

The ease of getting instant personal loans within minutes and also with 100% dispersal guarantee provided by numerous financial institutions. This has paved the path for various service providers.

Things to know for applying for a personal loan online

When applying for a personal loan through apps like cashe it is essential to know your limit, and you should know the purpose of taking a loan, too; then, you will know how much you need. There are some fees involved in personal loans, and the borrower should be aware of them before taking an online loan.

This fee includes a processing fee, prepayment, and late payment fee. Before applying for a personal loan, you should know what costs are involved and validate whether you can bear it. The amount of loan you take and the fee the lender charges can affect the EMI that you will be paying every month.

Credit score

The most important factor in taking a personal loan is having a good credit score. It refers to the credit line or history of the borrower. Every bank and NBFCs checks the credit score before giving personal loans to the customers. A good credit score should lie between 650 to 900. The higher the score you maintain, the more benefits you will get.

Eligibility Criteria

Eligibility criteria vary from bank to bank. The customer’s age should lie between 21 and 60, and the income should not be less than the EMI that you are opting for. If your present EMI crosses 40% of your monthly income, then you will not be eligible to get an additional personal loan.

Repayment plan

The lender will check repayment capability based on your income. It would help if you had a proper repayment plan before getting a personal loan. It ensures that you can able to pay the EMI on time without fail. Also, you should know about the interest rate, EMI, and repayment period. The EMI should be payable by you. So, know the purpose and take the loan.

Interest rates

You can avail yourself of personal loans with low-interest rates if you have good cibil score. You can negotiate with banks to provide you with low-interest rates. It will be beneficial for you to reduce the EMI amount and the repayment burden.

Conclusion:

Personal or salaried personal loan are the most convenient option to get funds in financial emergencies. The above-mentioned points are the most important factors to consider for personal loans. Online loans provide faster approval and quick processing of a loan. Research well about the loans, interest rates, flexible terms, hidden charges, etc, and then choose one.