In this fast-paced world, the quest for quick financial solutions often leads us into the realm of instant personal loans. These quick loans can be a true lifesaver in time of need, but beneath their seemingly straightforward exterior, there are intricacies and nuances that lenders may not always divulge. Join us on this insightful journey into the world of instant personal loans and money lending app, where we’ll uncover what often remains concealed.

- Swift and Convenient

Instant personal loans offer a remarkably swift and convenient way to access funds, just as their name. With minimal documentation and an expedited approval process, they serve as a welcome ally in the face of unforeseen financial challenges. However, amidst this convenience lies a subtle aspect that is important to recognize.

- Interest Rates

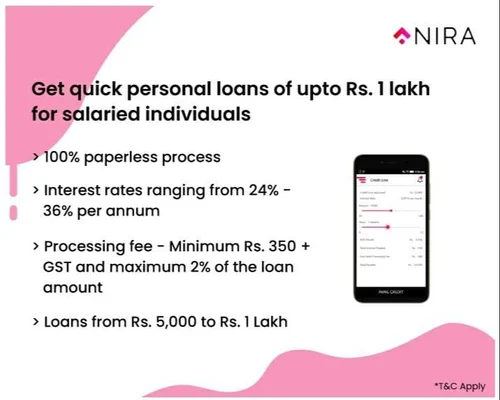

In a hurry to secure a personal loan or a pay-later limit, one might easily overlook the fine print concerning interest rates. This is where lenders exhibit a degree of subtlety. While a seemingly low interest personal loan may be prominently displayed, the true cost of borrowing can be concealed within an intricate web of additional charges.

It’s of utmost preference to pursue the terms and conditions carefully, seeking out any concealed expenses that could significantly elevate the overall cost of your loan.

- Credit Scores as Silent Arbiters

Lenders often downplay the role of your credit score in your loan app. Although they might not explicitly illuminate this aspect, individuals with higher credit scores generally receive more favorable interest rates. Hence, if you aspire to secure a personal loan under more advantageous terms, cultivating a robust credit score is of utmost importance.

- The Lure of Debt

A rather subdued topic that lenders may not overtly discuss is the potential entanglement in a debt cycle. While instant personal loans offer a quick solution, the ease of obtaining them can lead to repetitive borrowing, potentially resulting in an enduring burden of debt. Borrowers must exercise caution and awareness to avoid falling into this trap. A deep cost-benefit analysis can help you out in a situation like this.

- Compare Your Options

Some lenders often imply the uniqueness of their offering, subtly discouraging borrowers from exploring alternative lending avenues. While not explicitly promoting, they endeavor to keep borrowers within their exclusive ecosystem. Borrowers need to conduct thorough research and scrutinize a variety of lenders to ensure they secure the most favorable deal.

- Evade Catchy Charms

As borrowers, it’s essential to navigate through instant personal loans with a discerning eye. Here are a few tips to avoid succumbing to catchy marketing charms:

- Carefully Evaluate the Fine Print: Eschew superficial glances at the terms and conditions.

- Explore Options: Delve into multiple lending institutions and carefully evaluate the offers.

- Resist Overborrowing: Be disciplined and take out loans only for essential needs.

Therefore, instant personal loans are a potent financial tool when used judiciously. However, as a borrower, you must remain vigilant and well-informed to circumvent potential pitfalls and financial missteps. By using the tips offered here, you can harness the advantages of an online instant loan app while safeguarding your financial well-being.