Managing money is simpler than it has ever been in the modern digital era. You need a brokerage account to handle your investments, just as you need a wallet to hold your cash and cards. Your brokerage account serves as a financial center, whether your goals are long-term investment, trading options, or purchasing shares online, guiding you easily across the stock market.

An online account enabling stock, option, ETF, and other securities purchase and selling is a brokerage account. Consider it as your digital investment wallet, where you keep your money and access several investment prospects. Many investors handle their brokerage accounts on the run using a stock market app as technology develops. A brokerage account protects your money and enables you to invest and increase your wealth, the same as a wallet lets you spend when needed and securely stores your cash.

How a Brokerage Account Functions Comparatively to a Wallet

Whereas a brokerage account stores your money and securities, a real wallet stores your cash. You can buy shares online, invest in equities, or trade options with money you put into your brokerage account. Unlike a conventional savings account, a brokerage account lets you put your money to use and, over time, could create possible profits.

A brokerage account lets you purchase and sell stocks right away, much like you might get cash from your wallet anytime you need it. Fast withdrawals available in most modern stock market applications let you move money back to your bank account as needed. This liquidity guarantees that your investments stay easily available anytime you need them.

Although it helps you budget your expenditures, a wallet is where you save cash for daily needs. By enabling you to manage your investments, a brokerage account serves in a comparable capacity. Just as you determine how to spend your money in various contexts, you can set aside money for stocks, ETFs, and options, among other kinds of investments.

Another crucial element is security. A wallet stores your money; a brokerage account protects your investments similarly. Most top sites guarantee that your money and personal data are well safeguarded by using high-level encryption and security mechanisms. Many brokerage companies also provide insurance on your assets, therefore adding still another degree of security.

Why Would You Want a Brokerage Account?

If you want to begin creating wealth, you must have a brokerage account. It offers a safe and easy approach to trade options, purchase shares online, and stock market investment. Investing via a brokerage account lets your money work for you over time, producing returns unlike holding cash in a wallet, which loses value.

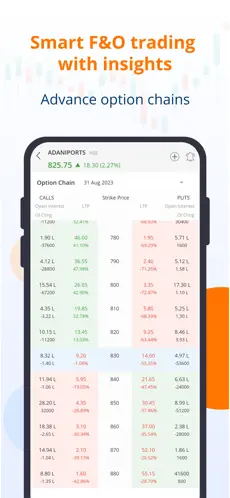

Managing your investments has never been more simple, thanks to the options trading app and stock market apps. These programs give real-time data, investment research, and trading tools to guide your judgments. Like a financial counselor right at hand, the top share market app provides insights into stock patterns, performance history, and future estimates.

Selecting the Appropriate Brokerage Account

Choosing a brokerage account requires careful thought on many elements. Low fees and commissions are absolutely vital since big expenses could reduce your income. For beginners, particularly, a user-friendly interface guarantees a flawless trading experience. Easy navigation, real-time market information, and access to several investing options—stocks, ETFs, options—should define the best share market app. Maintaining the safety of your investments also depends on strong security elements such as fraud prevention and two-factor authentication.

Conclusion:

More than just a trading tool, a brokerage account is your wealth management wallet for growth and control. Financial success depends on having a trustworthy brokerage account, whether your investment is in equities for the long haul or an options trading app for short-term profits. A brokerage account arranges and accessibly your investments, much as a wallet keeps your money orderly and easily available. If you have not yet started one, now is the ideal moment to start your path of investment and take charge of your financial future.