Knowing the many investment instruments at your fingertips is crucial now more than ever in the rapidly changing financial scene. Using a variety of tactics, such as investing in stocks, trading futures, or investigating mutual fund apps, can have a significant effect on your financial path, regardless of your level of experience.

Trading account for your ultimate gateway to financial markets:

Your first step into the global network of financial markets is a trading account. You can purchase and sell bonds, mutual funds, shares, and other securities with it. You can access a range of stock market investment opportunities by opening a trading account. You can’t effectively track your investments, make transactions, or manage your portfolio without this account. Actually, a lot of trading platforms these days provide integrated features that let you trade futures, buy in stocks, and keep an eye on the NSE option chain in real time.

Invest in equity for creating sustainable wealth:

Purchasing the stock or shares of a corporation entails investing in equity, thereby converting you into a part-owner. One of the most well-liked long-term wealth-building techniques is equities investing. Compared to other asset classes, stocks carry a greater amount of risk but also offer the potential for larger gains. It’s critical that you spread your portfolio over a number of sectors and industries in order to manage that risk. This mix of assets ensures an equitable approach to wealth building by shielding your investments from market volatility.

When investing in the stock market for the first time, it’s best to start modestly and expand your portfolio gradually. Whether your goal is to keep onto equities for long-term appreciation or invest for short-term gains, equity investments provide flexibility. Online resources along with a mutual fund app are widely used by investors to simplify their equity holdings and improve portfolio management.

Future trading for that strategic move:

Future trading is a different kind of investing strategy that lets you buy or sell shares at a set price at a later time. This approach is popular for trading fluctuations in commodity, currency, and stock prices. Future trading is a tool used by investors to bet on price increases or as a hedge against possible market downturns.

While future trading can be extremely profitable, it also includes great risk, making it better suited for seasoned traders. Futures contracts are attractive to investors who want to leverage their cash because they usually involve a smaller upfront commitment than regular stock trading. Nonetheless, vigilant observation of market conditions is necessary for future trading, and following the NSE option chain in real time might be beneficial.

Mutual funds apps and NSE option chain live as powerful tools for traders:

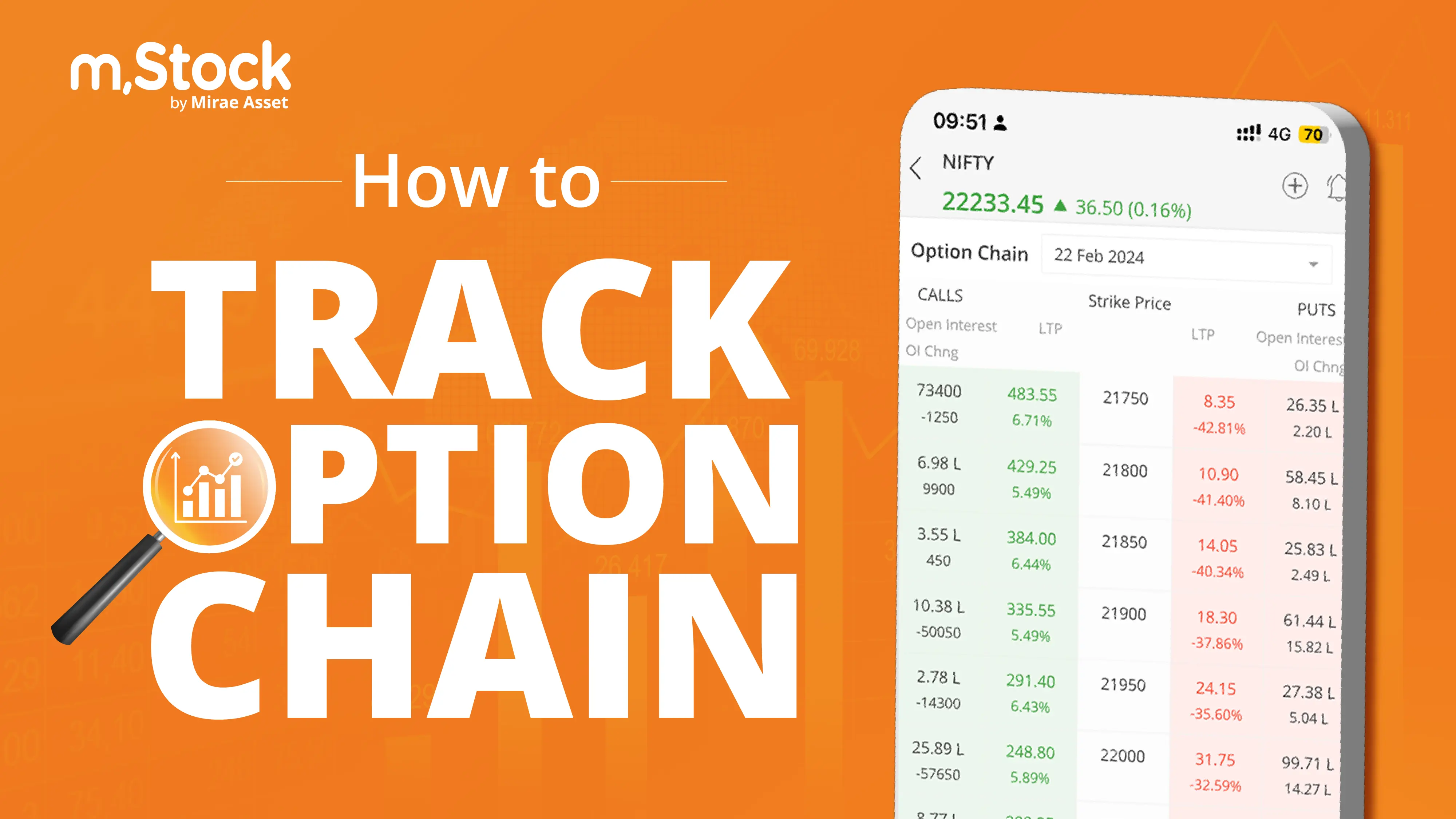

For those who trade futures or options, the NSE option chain live is a vital resource. It offers up-to-date information on every outstanding options contract for a specific stock or index, including the market price, target price, quantity, and open interest. Traders can get a full understanding of market mood by keeping an eye on the option chain, which enables them to make more calculated investment decisions.

Mutual funds present a strong alternative for those seeking a more hands-off approach. Investing in an assortment of assets such as bonds, stocks, or other securities is made simpler with the help of a mutual fund app. These apps give investors a plethora of options catered to different risk tolerances and financial goals.

Conclusion:

Building and maintaining money in the constantly shifting environment of investing requires having exposure to the appropriate tools and tactics. The options are endless, ranging from creating an account to trade to purchasing stocks, investigating future trading, and utilizing a mutual fund app. Making better investing selections and managing the stock market can be made easier if you use resources like NSE India and stay current with the NSE option chain live. You can successfully manage risks and attain long-term financial growth with the appropriate strategy.