In today’s fast-paced world, financial emergencies can arise unexpectedly. Whether it’s for medical expenses, home repairs, or other urgent needs, having access to funds quickly is essential. This is where instant loan approval and short-term loans come into play. Let’s explore how they work, their benefits, and what you need to consider before applying.

What is an Instant Loan?

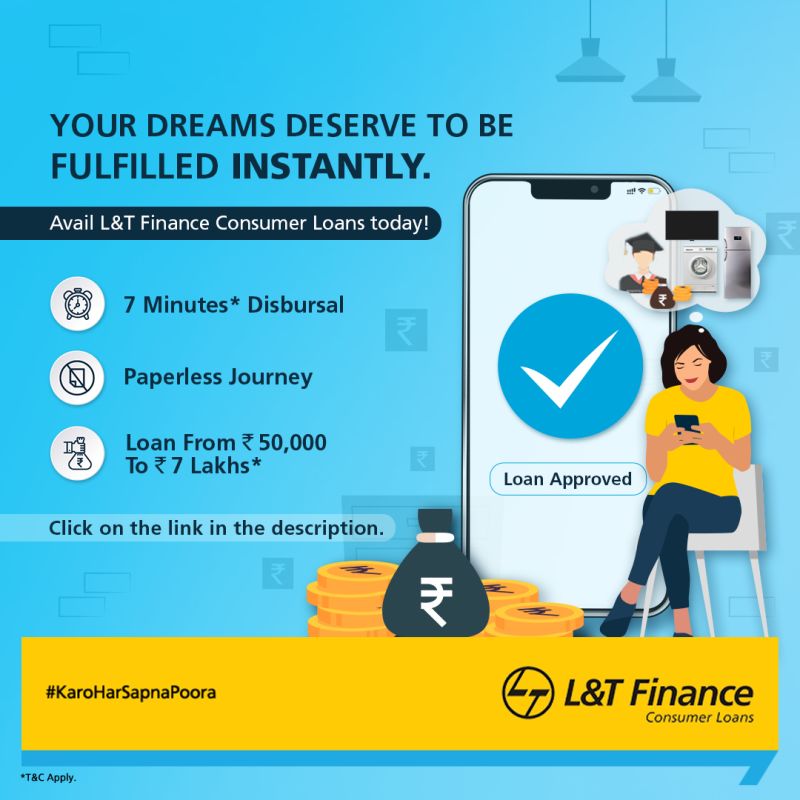

An instant loan is a type of loan that provides quick access to funds, often with minimal documentation. These loans are designed to help borrowers meet urgent financial needs without the long wait times typically associated with traditional loans. With many lenders offering online applications, you can often receive approval within minutes and funds within hours.

Understanding Short-Term Loans

Short-term loans are designed to be repaid over a short period, usually within a few weeks to a year. They are an excellent option for those who need immediate cash but can pay it back quickly. Short-term loans can cover a range of expenses, including:

Medical bills

Car repairs

Unexpected travel

Household emergencies

Benefits of Instant Loan Approval and Short-Term Loans

Quick Access to Funds: One of the most significant advantages is the speed at which you can access cash. Many lenders offer instant approval, allowing you to get the money you need without delay.

Minimal Documentation: Unlike traditional loans that require extensive paperwork, instant loans often require just basic personal information, making the application process straightforward.

Flexible Use: Short-term loans can be used for various purposes, giving you the flexibility to handle financial emergencies as they arise.

Improves Credit Score: If you make timely repayments, short-term loans can help improve your credit score, making it easier to secure larger loans in the future.

No Collateral Required: Many instant loans are unsecured, meaning you don’t have to put up any assets as collateral, reducing the risk for borrowers.

Considerations Before Applying

While instant loans can be helpful, it’s crucial to approach them with caution. Here are some factors to consider:

Interest Rates: Short-term loans often come with higher interest rates than traditional loans. Ensure you understand the total repayment amount before agreeing to the loan.

Loan Terms: Be clear about the repayment terms and ensure you can meet them to avoid penalties or further debt.

Lender Reputation: Research lenders thoroughly. Look for reviews and ratings to ensure you’re working with a reputable company.

Borrow Only What You Need: It can be tempting to borrow more, but only take what you need to reduce your financial burden.

Conclusion

Instant loan approval and short-term loans can be lifesavers in times of financial need. They provide quick access to funds and flexibility for borrowers. However, it’s essential to weigh the benefits against potential risks. By understanding your options and responsibilities, you can navigate the world of short-term loans effectively and make informed financial decisions.