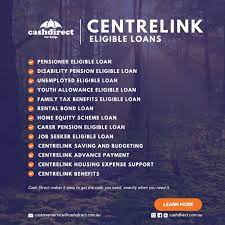

If you’re in need of financial support and wondering whether you’re eligible for Centrelink assistance, you’re not alone. Many Australians turn to Centrelink for various types of support, including loans for pensioners, disability pension advance payments, and other government benefits. Understanding whether you qualify for these services can make a significant difference in managing your financial situation.

In this guide, we’ll explain the key factors that determine your Centrelink eligibility, the different types of payments available, and how to apply for assistance in just a few steps. Whether you’re seeking immediate financial support or looking to explore long-term options, we’ve got you covered.

Understanding Centrelink Eligibility

Centrelink provides a wide range of services designed to help Australians in various circumstances, including unemployment, disability, and retirement. However, eligibility for Centrelink payments is determined by several factors, including your income, assets, and personal situation. It’s important to know the specific requirements before applying to avoid delays or complications.

H3: Key Criteria for Centrelink Eligibility

- Residency: You must be an Australian resident or hold a permanent visa to qualify for most Centrelink benefits. Some temporary visa holders may also be eligible, depending on their situation.

- Income and Assets: Centrelink has strict limits on how much income and assets you can have and still qualify for benefits. These thresholds vary depending on the type of payment you’re applying for.

- Age: Some payments, such as the Age Pension, require that you meet specific age requirements. In contrast, the disability pension advance payment does not have a strict age limit, as it’s designed to help those with long-term disabilities.

- Health Condition: For those applying for the Disability Support Pension (DSP), a medical condition that prevents you from working may be required. The severity of your disability will be assessed to determine your eligibility for support.

- Employment Status: If you’re unemployed or underemployed, Centrelink offers financial assistance through payments like JobSeeker, but your job search efforts will need to be documented.

Loans for Pensioners

One of the benefits offered by Centrelink is the opportunity to apply for loans for pensioners. These loans are designed to provide short-term financial relief for retirees who may need extra funds to cover unexpected expenses. Whether you need help with medical bills, home repairs, or everyday living costs, loans for pensioners can be a practical solution.

How Loans for Pensioners Work

Centrelink’s Pension Loans Scheme allows eligible pensioners to borrow against the equity in their homes. This is a government-backed loan that offers flexibility and affordable interest rates. Unlike traditional loans, these are designed specifically for pensioners who may not qualify for regular financing due to their age or income status.

Eligibility Criteria:

- You must be of pension age and qualify for the Age Pension.

- You can borrow a lump sum or receive smaller, regular payments.

- Your property acts as security for the loan, so you’ll need to own real estate.

This type of loan can be a lifeline for those who find themselves needing immediate funds, with repayments typically deferred until the sale of the home or the borrower’s passing. Be sure to carefully consider your financial situation before committing to such a loan.

Disability Pension Advance Payment

If you receive the Disability Support Pension (DSP), you might be eligible for a disability pension advance payment. This advance allows you to access part of your pension upfront, which can help you manage larger, immediate expenses such as medical treatments, home modifications, or equipment necessary to improve your quality of life.

How to Apply for the Disability Pension Advance Payment

The application process for a disability pension advance payment is relatively straightforward. You can apply directly through Centrelink’s website or visit a service centre. However, it’s important to note that this is an advance on your regular payments, meaning that future payments will be reduced until the advance is repaid.

Eligibility Requirements:

- You must currently be receiving the Disability Support Pension.

- You cannot have taken out another advance within the same 12-month period.

- Your financial situation will be assessed to determine if an advance payment is appropriate for you.

These payments can provide critical financial support when you need it most, allowing you to manage unforeseen expenses without jeopardizing your long-term financial security.

How to Check Your Centrelink Eligibility

Checking your eligibility for Centrelink services is easier than ever. Centrelink offers an online eligibility checker that can help you determine which payments you qualify for in just a few minutes. Here’s a step-by-step guide to help you through the process.

Step-by-Step Guide to Checking Eligibility

- Create a myGov Account: If you don’t already have one, you’ll need to set up a myGov account. This is the central hub for accessing government services, including Centrelink.

- Link Your Centrelink Account: Once your myGov account is ready, link it to Centrelink by following the on-screen instructions.

- Use the Eligibility Checker: Centrelink’s online eligibility tool will ask you a series of questions about your personal circumstances, including your income, assets, and living situation. Answer these questions accurately to get the most precise assessment of your eligibility.

- Apply for Benefits: If the eligibility checker determines that you qualify for one or more Centrelink payments, you can start the application process immediately through the same portal.

Why Eligibility Matters

Understanding whether you qualify for benefits like loans for pensioners or a disability pension advance payment is crucial for managing your financial wellbeing. These services are designed to provide support when you need it most, and applying for them can help relieve the stress of financial uncertainty.

Final Thoughts on Centrelink Eligibility

Whether you’re looking for short-term assistance through loans for pensioners or need an advance on your disability pension, knowing your eligibility for Centrelink payments is the first step towards financial stability. With the Centrelink eligibility checker, you can quickly determine which payments and benefits are available to you.

Conclusion: Take Control of Your Finances with Centrelink

Centrelink offers vital financial support for many Australians, from loans for pensioners to the disability pension advance payment. By checking your eligibility, you can access the financial assistance you need to cover life’s unexpected costs. With an easy-to-use online eligibility checker, you can find out if you qualify for these benefits in just a few minutes.